Simplifying Invoice Factoring & Asset-based Lending

Simplifying Invoice Factoring & Asset-Based Lending Alternative Finance Solutions Made Easy In today’s fast-paced business world, companies often need extra money. They need it to

Simplifying Invoice Factoring & Asset-Based Lending Alternative Finance Solutions Made Easy In today’s fast-paced business world, companies often need extra money. They need it to

Invoice Factoring for Sustainable Cash Flow Rapid growth can be a double-edged sword for small and medium-sized businesses (SMBs) in Canada. Without the right business

Learn how Canadian small businesses can resolve CRA debt, improve cash flow, and regain financial stability with flexible financing from EBF.

How to Become Bankable Again with Alternative Financing Creating Growth Opportunities for your business No two businesses function in the same way. This fact can

This Labor Day, celebrate the hardworking individuals who drive your business forward. Explore ways to recognize and support your team while fostering a culture of appreciation.

Invoice Factoring Rescues Struggling Businesses How EBF Boosted HVAC Growth Post-COVID Rapid growth can seem out of reach for small business owners facing setbacks, but

In 2026, resilience and transformation are essential for Canadian business success. While traditional banks maintain tight lending standards, agile funding tools, specifically working capital loans for daily liquidity and asset-based loans for scalable, collateral-backed growth, allow businesses to thrive without the rigid constraints of conventional financing.

Explore fast funding and alternative working capital strategies like invoice factoring to help Canadian SMBs overcome cash flow challenges and fuel sustainable growth.

Discover how EBF’s invoice factoring helped a Canadian environmental firm solve cash flow gaps, ensuring fast funding and 30% growth in recovery services.

This article explains how factoring can help supplier partnerships. It can also strengthen supply chain stability. This will keep Canadian small and medium-sized businesses competitive in 2026.

A Canadian electrical wholesaler used EBF’s $700K factoring facility which helped them deal with long receivable cycles, and more!

Discover how working capital construction financing, like receivables financing, can enhance cash flow for Canadian construction businesses facing cash flow challenges. Explore invoice factoring’s benefits and how it might be the right solution for your company’s financial health.

Struggling with CRA arrears, bad credit, or seasonal cash flow gaps? EBF’s invoice factoring delivers fast, flexible business funding for SMBs across Canada.

Discover the risks of Merchant Cash Advances and explore invoice factoring—fast, debt-free business financing for Canadian SMBs.

Learn how to navigate loan covenants, borrowing limits, and asset caps. Smart debt financing tips for Canadian SMEs from Express Business Funding.

Discover how invoice factoring gave a Canadian book publisher fast funding, sustainable cash flow, and global growth—without debt or delays.

Learn how EBF’s invoice factoring helps seasonal businesses stay afloat with fast funding and sustainable cash flow.

Discover how invoice factoring and asset-based lending helped a business overcome financial roadblocks, improve cash flow, and fuel growth with Express Business Funding.

Learn how Express Business Funding stays ahead in the evolving finance landscape. Explore trends like fintech, regulatory changes, ESG, and more, and how EBF leads with agility, innovation, and client-focused solutions.

Discover what to expect during the onboarding process with EBF. From initial consultation to receiving your funds.

Discover how Express Business Funding helps businesses in unbankable situations recover, regain financial health, and return to traditional finance through tailored alternative funding solutions.

Discover how Canadian businesses can optimize their tax position through strategic finance solutions with Express Business Funding.

Learn how working with a business consultant or strategic advisor can help streamline operations, improve cash flow management, and support your company’s long-term financial goals.

Is invoice factoring the right fit for your business? Let’s Determine of Invoice Factoring Aligns with Your Goals.

Discover the essential traits that show your company is ready for M&A financing. Learn how Express Business Funding supports business owners in Canada with strategic growth solutions.

Discover how working capital loans can help manufacturers manage cash flow, invest in growth, and maintain smooth operations. Learn about tailored financing solutions for the manufacturing industry.

Secure your company’s financial future with EBF’s 8 tips for unforeseen events in your businesses’ financial future.

How Alternative Financing Helps Businesses Thrive & Grow Small and medium-sized businesses (SMBs) are increasingly choosing for its speed and flexibility. These solutions help businesses

The Top 5 Invoice Factoring Myths Debunked Separating Fact from Fiction Navigating business finance can feel overwhelming, especially with so much misinformation about invoice factoring

A growing construction firm overcame lender fatigue and CRA arrears with a $4M factoring facility and $700K asset-based loan from EBF. Discover how strategic financing fueled cash flow, supplier relationships, and long-term business growth.

Discover why financial consulting services are essential for business growth, resilience, and financial success. Explore how strategic planning, financial management, and risk mitigation help businesses thrive with Express Business Funding.

Wondering if it’s the right time to grow your team? Discover key growth strategies to help you make a confident hiring decision.

Discover how companies fund mergers and acquisitions. Learn why choosing the right financing partner is key for growth. Explore valuation, due diligence, deal structuring, and financing options with Express Business Funding.

Discover how EBF’s alternative finance maximizes capital injection for business growth and fatigue in this optimal guide.

Simplifying Invoice Factoring & Asset-Based Lending Alternative Finance Solutions Made Easy In today’s fast-paced business world, companies often need extra money. They need it to

Invoice Factoring for Sustainable Cash Flow Rapid growth can be a double-edged sword for small and medium-sized businesses (SMBs) in Canada. Without the right business

In 2026, resilience and transformation are essential for Canadian business success. While traditional banks maintain tight lending standards, agile funding tools, specifically working capital loans for daily liquidity and asset-based loans for scalable, collateral-backed growth, allow businesses to thrive without the rigid constraints of conventional financing.

Discover why EBF funding is the ideal choice for your business needs, with flexible solutions and rapid access to capital that surpass traditional methods.

Unlock the benefits of bridge financing as a strategic tool for businesses needing quick capital.

Discover how Asset-Based Lending works in Canada. Learn what assets qualify for EBF’s flexible funding.

Discover how working capital construction financing, like receivables financing, can enhance cash flow for Canadian construction businesses facing cash flow challenges. Explore invoice factoring’s benefits and how it might be the right solution for your company’s financial health.

Learn what working capital is and why your Canadian SME needs it. EBF offers fast, ethical financing solutions.

Discover the risks of Merchant Cash Advances and explore invoice factoring—fast, debt-free business financing for Canadian SMBs.

Learn how to navigate loan covenants, borrowing limits, and asset caps. Smart debt financing tips for Canadian SMEs from Express Business Funding.

Discover how invoice factoring and asset-based lending helped a business overcome financial roadblocks, improve cash flow, and fuel growth with Express Business Funding.

Learn how Express Business Funding stays ahead in the evolving finance landscape. Explore trends like fintech, regulatory changes, ESG, and more, and how EBF leads with agility, innovation, and client-focused solutions.

Discover what to expect during the onboarding process with EBF. From initial consultation to receiving your funds.

Learn how strategic asset allocation helps Canadian businesses manage risk, align investments with financial goals, and ensure long-term sustainability.

Discover how Express Business Funding helps businesses in unbankable situations recover, regain financial health, and return to traditional finance through tailored alternative funding solutions.

Discover how Canadian businesses can optimize their tax position through strategic finance solutions with Express Business Funding.

Learn how working with a business consultant or strategic advisor can help streamline operations, improve cash flow management, and support your company’s long-term financial goals.

Learn the key differences between real estate finance and asset-based lending for Canadian business owners. Discover the right financing solution to fund growth, preserve capital, and manage risk.

Discover the essential traits that show your company is ready for M&A financing. Learn how Express Business Funding supports business owners in Canada with strategic growth solutions.

A growing construction firm overcame lender fatigue and CRA arrears with a $4M factoring facility and $700K asset-based loan from EBF. Discover how strategic financing fueled cash flow, supplier relationships, and long-term business growth.

Discover how a lease buyback empowers businesses to unlock capital from owned equipment—maintain asset use, improve cash flow, and enjoy tax advantages.

Discover why financial consulting services are essential for business growth, resilience, and financial success. Explore how strategic planning, financial management, and risk mitigation help businesses thrive with Express Business Funding.

Wondering if it’s the right time to grow your team? Discover key growth strategies to help you make a confident hiring decision.

Discover how companies fund mergers and acquisitions. Learn why choosing the right financing partner is key for growth. Explore valuation, due diligence, deal structuring, and financing options with Express Business Funding.

Discover how EBF’s alternative finance maximizes capital injection for business growth and fatigue in this optimal guide.

Simplifying Invoice Factoring & Asset-Based Lending Alternative Finance Solutions Made Easy In today’s fast-paced business world, companies often need extra money. They need it to

How to Become Bankable Again with Alternative Financing Creating Growth Opportunities for your business No two businesses function in the same way. This fact can

Discover how asset-based lending works and whether it’s the right fit for your business. Learn how this form of alternative finance can help you access capital quickly using your business assets as collateral.

Discover the risks of Merchant Cash Advances and explore invoice factoring—fast, debt-free business financing for Canadian SMBs.

Discover what to expect during the onboarding process with EBF. From initial consultation to receiving your funds.

Discover how Express Business Funding helps businesses in unbankable situations recover, regain financial health, and return to traditional finance through tailored alternative funding solutions.

Discover how Canadian businesses can optimize their tax position through strategic finance solutions with Express Business Funding.

Learn how working with a business consultant or strategic advisor can help streamline operations, improve cash flow management, and support your company’s long-term financial goals.

Discover what DIP financing is and how it supports businesses in bankruptcy or financial distress with interim funding, expert guidance, and a clear step-by-step process.

Discover why financial consulting services are essential for business growth, resilience, and financial success. Explore how strategic planning, financial management, and risk mitigation help businesses thrive with Express Business Funding.

Discover how professional financial guidance helps businesses in distress recover. Learn how Express Business Funding supports crisis management, debt restructuring, and long-term financial stability with expert consulting services.

Discover how companies fund mergers and acquisitions. Learn why choosing the right financing partner is key for growth. Explore valuation, due diligence, deal structuring, and financing options with Express Business Funding.

Discover how EBF’s alternative finance maximizes capital injection for business growth and fatigue in this optimal guide.

Facing financial distress? Discover how Debtor-in-Possession (DIP) financing provides Canadian businesses with the operational funding they need to navigate bankruptcy protection and achieve financial recovery.

Our team takes pride in being a trusted financial partner across Canada. We dive deep into your operations, identify pain points, growth opportunities, and deliver strategies that guarantee success. With EBF, you’re not just getting funds; you’re gaining a partner committed to your long-term growth and sustainability.

We specialize in alternative financing solutions for businesses in need of capital injections that keep your business moving forward. Unlike traditional loans, our solutions are flexible and expedient – perfect for businesses needing working capital to cover taxes, payroll, inventory or any other business related expenses.

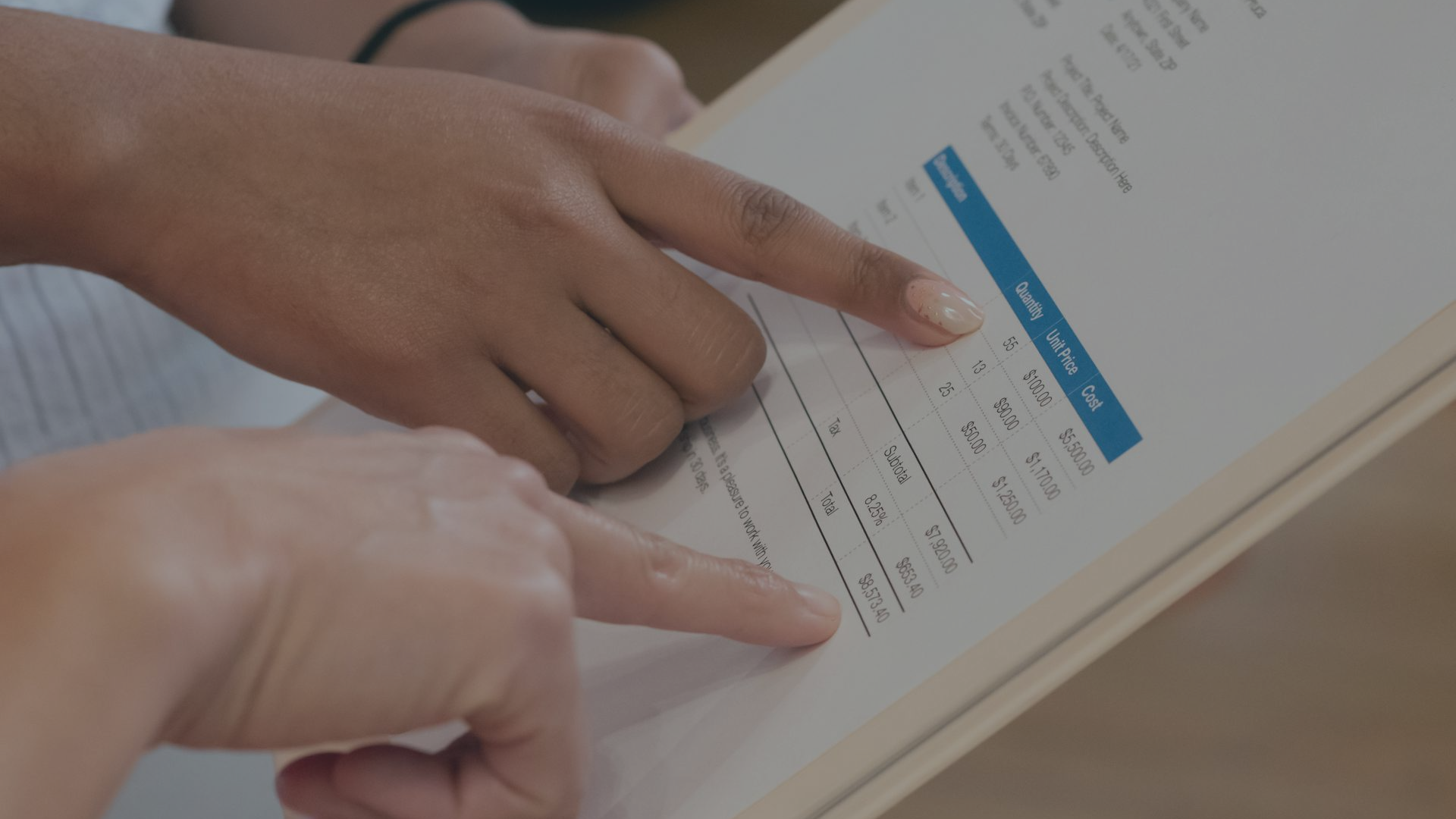

Unlock cash flow trapped in unpaid invoices with our flexible factoring solutions. Accelerate your working capital without taking on additional debt. No more waiting 30,60, or 90 days to get paid. Learn about invoice factoring today.

Explore FactoringLeverage your company’s assets, like real estate, to secure a credit facility. Ideal for businesses seeking growth capital or operational funding.

Explore ABLSpecialized financing solutions for companies in the restructuring process. Maintain operations while navigating financial transitions.

Explore DIP Financing

Copyright © 2025 Express Business Funding