Optimized Funding For Sustainable Business

Leverage our industry-specific financial expertise to access capital solutions that align with your company's strategic objectives and growth trajectory.

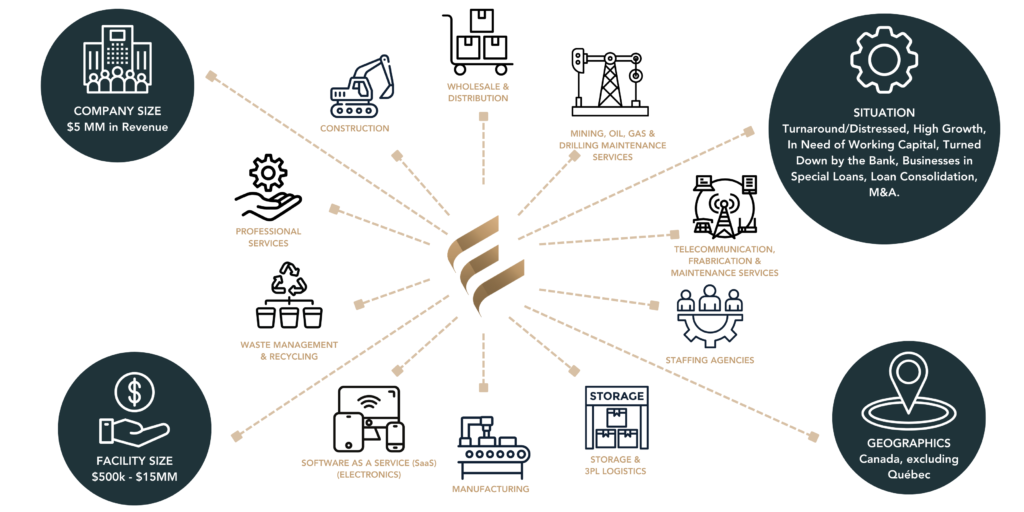

Welcome to EBF, your trusted financial partner to the manufacturing, construction, staffing and services industries across Canada. For over 20 years, we’ve empowered small and medium businesses (SMEs) with optimized funding solutions for your business. Our industry-specific financial expertise ensures you access working capital and financial solutions tailored to your company’s unique goals and trajectory. Whether you’re scaling operations, managing cash flow, or seizing new opportunities, EBF delivers the capital you need – when you need it.

FINANCING OPTIONS TO KEEP YOUR BUSINESS OPERATIONAL:

We specialize in alternative financing solutions for businesses in need of capital injections that keep your business moving forward. Unlike traditional loans, our solutions are flexible and expedient – perfect for businesses needing working capital to cover taxes, payroll, inventory or any other business related expenses.

INVOICE FACTORING

Unlock cash flow trapped in unpaid invoices with our flexible factoring solutions. Accelerate your working capital without taking on additional debt. No more waiting 30,60, or 90 days to get paid. Learn about invoice factoring today.

Explore FactoringASSET-BASED LENDING

Leverage your company’s assets, like real estate, to secure a credit facility. Ideal for businesses seeking growth capital or operational funding.

Explore ABLDIP FINANCING

Specialized financing solutions for companies in the restructuring process. Maintain operations while navigating financial transitions.

Explore DIP FinancingIMPROVE YOUR RECEIVABLES COLLECTION PROCESS WITH A FINANCIAL PARTNER THAT YOU CAN TRUST!

Invoice Factoring,also known as Accounts Receivable Factoring, allows you to streamline your business by providing access to outstanding invoices before your customer pays them. We’ve empowered thousands of companies in diverse industries with optimized funding for their businesses. Securing custom business financing solutions is fast and straightforward, with funding available when you need it most.

Embrace rapid growth, secure discounted supplier costs, or stabilize financial distress and act when action is needed with Invoice Factoring from EBF.

INDUSTRIES WE WORK WITH

EBF MAKES IT POSSIBLE TO GET YOUR BUSINESS BACK ON TRACK BY UNLOCKING CASHFLOW.

Whether you have extensive experience with alternative financing solutions or none at all, EBF makes transparency and education a core focus of our business. Our education hub is filled with useful information which you can use to learn more about EBF and the Alternative Financing Industry.